#OONO!4: How Stable? The Valley, Crypto + US Treasury Walk Into A Bar

How could SVB (Silicon Valley Bank)- the 16th largest bank in the US & 2nd largest one to ever collapse– go down in just two days? Simple. No, it's not crypto. It's not tech. It's not even Elon!

The answer is far from complicated. No, it’s not crypto. It’s not tech. It’s not even Elon – even though KVP is sure there will be an Elon spin somewhere.

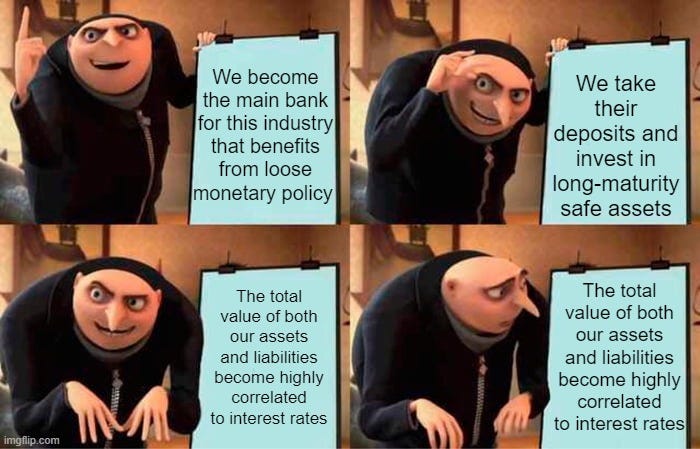

It’s simply due to a gross mismanagement blunder from SVB’s management, that resulted in a significant duration mismatch between liabilities (i.e. depositor funds at SVB) & where those deposits were placed (Multi-Year US treasuries).

For those of you who have been lucky enough not to be glued to your everyday Macro + Crypto screens, the last few days have been nothing short of epic in a part of the world that you don’t tend to hear too much volatility from– Nah, it’s definitely not crypto… With the likes of Luca Luna, 3 Crooks 3Arrows, Celsius, BlockFi, FTX & Sam Bankrupt Fraudman (SBF) blow ups… crypto at times feels more volatile than volatility.

This event stems from the “mecca” of the start-up game, Silicon Valley, on the West Coast of the US of A. Silicon Valley Bank (SVB), 16th largest in the US & by far the most prominent tech concentrated bank with literally thousands of venture tech companies as clients, was shut down on Friday (March 10) by the government.

So when VCs started to panic post a $2B loss from a +$21B bond portfolio sale & announced need for an equity raise of $2.25B, it led to a bank run of start-ups in the respective VC portfolios.

These start-ups were looking to pull their money out of SVB i.e. better to run first & ask questions later, than to be frozen & unable to make payroll to their employees & commitments to their partners, as well as investors.

We saw a very rare & commendable, A+ Sunday move 👏 from the regulators & policy makers with a joint statement out of the US Treasury, Federal Reserve & the FDIC– that entails that all deposit holders’ assets are backed to the fullest. It’s also worth noting in bold below– that this is not a bail-out (i.e. saving capital holders—be they equity, credit or a hybrid of an entity), but making sure that depositors get their money back.

Washington, DC -- The following statement was released by Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg:Today, we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today’s actions demonstrate our commitment to take the necessary steps to ensure that depositors’ savings remain safe.

Why is this so important?

Well, if we hadn’t received this announcement over the wkd, it is likely that we would have seen a fear-driven bank run cascade across the majority of Small & Medium Sized banks across the US, with potential ripples in other parts of the world. So, what was initially termed a ‘start-up extinction event’ in the Valley (given SVB’s concentration risk & monopoly position among the predominantly tech bros – when competitive edge, turns into a death spiral), would have ultimately cascaded into a multi-sector extinction event, with the almost certain outcome of the US just being left with a handful of bottlenecks leviathans of the banking world.

If one’s population stops believing in the credibility, security & safety of their banks, it is not a far extrapolation for that same population to look at their central bank with a new critical eye. And if you are a big bank & think you’re an impenetrable fortress – well clearly you forget the blood in the water season during the 2008-2009 crisis, where E-V-E-R-Y bank was on a slippery slope of losing their clients & partners faith.🦈☠️

Again– one cannot state this enough.

Everyone always ask, what’s the value of Bitcoin? Well, what’s the value of the US Dollar?

The value of the USD is tied to a corporation with a monopoly on violence, i.e. a government.

In this case that violence, or potential violence (read prosecution, fines & potential jail-time) are meant to enforce the use & therefore faith in the US dollar – even though +80% of all US dollars in existence were printed in the last 22months (from $4T to $20T according to @ Daniel Levi @ TechStartUps.)

So, the value of the dollar or any other fiat or asset is determined by the number of people who are willing to accept its worth. This faith, despite being built on the consistent Zero Hedge history of all fiat currencies eventually going bust – the St. Louis Fed own research shows that the USD has lost 63% of its value since 1983 (that’s just 40yrs folks) – is an important masquerade to maintain, until there is an alternative or series of alternatives to what is c. +60% of world reserve currencies & by some estimates over 80% of global trade occurs in USD, with more than 60% of debt issued being in the USD.

This—for a country that is less than 24% of Global GDP & under 5% of the World’s 8. Billion. People. Now, if that’s not an elitist imperialistic skew… 5% pretty much dictating to 95%* then KVP does not know what is. 😮💨

*With some rare exception like China 👀

Hmm.. if only there was an asset or two out there, that some centralized authority did not have the power to print the denominator to infinity! 🤔

Yet KVP digresses– this is important because despite the statement implying “a systematic risk exception”, why should US tax-payers in other banks continue to only have a $250K insurance cap on their hard-earned & already taxed money? And this is the same tax-payer that has funded +trillions in US military campaign abroad– including a recent XXX to Ukraine - & as well as Trillion in the Political Flavor of the month game. So, Net-Net, this is a gain for US Taxpayers if it’s blanketed across the nations. Now with that said, the road to many a hell is paved with good intentions. The issue here will be: Do the banks then take even more risk… & here again not more regulation is needed, but better regulation– not to mention that similar to Singapore, your assets should always be sitting in your name regardless of what local institution you hold them in.

It's funny how everyone talks about the Clinton & Gore years as a golden age (they got luck, tech, productivity explosion, low interest rates & sweet spot of the boomers productivity + investing), when actually two huge structural negative things were set by that US administration that are almost never discussed. And that’s Macro folks, the event you think that is occurring this month, was years in the making… ( a la Ukraine|NATO <> Russia).

1. Escalation of globalization—which has now fully come back to haunt the country, as it exponentially opened up the divide between those that have (the east & west coast, otherwise known as home to the incumbent elites & clickbait mainstream media) & those that do not (“Flyover” country that got gutted from outsourcing to cheaper labor across the globe). This divide was decades in the making & will also take decades in the making to mend – if that could ever be mended.

2. The last was a banking act that was originally orchestrated during the great depression, called the Glass-Steagall Act. In essence, it separated Investment Banking (where higher risks are taken for seeking higher returns, traditionally with the partners or banks proprietary capital) from Commercial Banking (focused on the less exciting yet in many ways more important role of financing, loans & deposits for individuals & corporations)– as the commingling of the two had run among during the crash that helped spur the great depression. When the Clinton administration got rid of the Glass-Steagall’s Act, the Investment Banks went on an unprecedented binge— as they could not get access to bigger balance sheets & could now play the “too big to fail” card (before they could be left to blow themselves to bits, as they did not have mainstreet money to punt with).

So on Glass-Steagall’s Act being revoked, we full tilt into the regime we’ve gotten to know from Wallstreet; “Heads, Wallstreet wins. Tails, the Tax Payer Loses”. And of course, years later we had the subprime crisis– which may have occurred regardless, but it would have been at a significantly lower magnitude.

Why is this important? Well, the GFC (2008-2009 Subprime crisis) got us into this crazy QE printing game– where central bankers forgot (& the rest of the world) that they were not omnipotent & policy makers (especially fiscal policy makers during the Obi regime, who over the crisis, refused to step in & help in the recovery of the economy i.e. it was loose monetary policy, but the fiscal policy at the time – enter the Reps – was one of tightening).

Ok, Enough Talk – Price Action, How, What, Where Are The Lambos?

Near-term very bullish for risk-assets:

-Equities, especially banks, are likely to see some short squeeze interest (making them great sector long-short plays here).

-Crypto – USDC is currently at $0.9912, up c. +13% from a low of $0.879, as the $3.3B (c. 8%) of reserves that they held at SVB is now no longer a risk. Expecting the alts & ETH to continue to outperform BTC over the next few sessions.

-Treasuries will likely see yields rise & yes—KVP thinks it’s wrong to read too much into the Fed changing its gears off the bank of this SVB failure but again, this is linked to a classic mng fck up of duration mismatch of its books, akin to what was seen on numerous occasions in 2008 financial crisis & a vintage error.

-Currencies are similar, with the USD acting as BTC s. Atls, i.e other FX tending to outperform the USD. Folks are likely being too early into reading into a change of gear from the Fed.

i.e. What did you think was going to happen when we go from record low interest rate environments to a Fed hiking regime? It won’t just be butterflies, rainbows & sunshine. A robust & healthy ecosystem needs a reset now & then, despite how painful that may be, or eventually, the ecosystem collapses on itself.

-Commodities - no hard views – yet structurally for the Year of the Water Rabbit @ D·Central, we think a lot of folks are sleeping on China & the potential demand that could come this year (net positive for CMDs). And yes, another inflationary structural wind for the world– you have to keep in mind: China has been in slow-motion pretty much since COVID-19.

Now, does this mean the Fed’s gunning for full QE?

This is the eventual end game, unless fiscal & governmental structural reform take a massive 180 (likely less than 1% delta – as it all just seems to be tribalistic exchanges & jabs).

It’s looking like the majority of the US, Europe & Western Countries are being governed by those who are so dislocated from the average plight of their citizens & hard-working taxpayers, not to mention many of whom, regardless of age, likely need some cognitive & psychological testing hurdles to just check if their gears are in order.

The only delta is at least the emerging markets know their governance was flawed from day one & it’s only getting clearer + undeniable for the majority of the West.

The end result of this, is once again– the only game in town will end up being monetary policy & the Feds, ECBs, BoJs, RBAs, BoEs, BoCs & RBNZ of the world will do a glorious unwinding of this hiking/higher rates regime that we are in.

However, KVP does not feel SVB will be that catalyst… jobs data in the US is still immensely strong, inflation still does not look to be ‘tamed’, we’ll also likely see the strongest China in the year of the Water Rabbit since 2019 (4yrs ago) & that should be a big inflationary wind on the rest of the world. On top of that, continued conflict between the Ukraine & Nato|US proxy camp vs. Russia is inflationary.

One thing about SVB is quite a few people called this right, even when dealing with a lot of incomplete information & kudos to those in the arena– one of the greatest cuts on the situation & frameworks around it came from the All-In Pod.

Generally speaking, the catalyst that changes the direction of a central bank is one that few people catch on & is only clear in hindsight. Whether that’s a tactical nuclear display in Europe or some left-field 10-sigma event… for now, we still seem to be in a hiking regime & with the QE button firmly in the red. The risk is not on Fed cuts, but further hikes.

Yes, the future pace is likely not going to be anywhere near what it was last year, but let’s not forget the strongest factor that plays into a policy makers playbook – “saving face!”.

Before the Fed starts to cut again, it’s going to be PAINFULLY obvious that they have to start cutting. Recall it had to get PAINFULLY obvious before they started hiking.

Again, remember this Fed has overseen- in the last 22 months- 80% of all the US Dollars ever printed– by default they are right to hold the course, yet potentially alter the pace to a cruise control series of 25bps & then a 2-4 quarter pause to review the lay of the land.

Have a beautiful wk everyone, it’s gonna be a great one – if you are in Dubai, Holland or France over the next few wks, give KVP a shout… “same number, same hood, it’s all good & if you don’t know, now you know… D·Ceeeeeeeeeeeentral!”

Namaste,

KVP

****

Start·End = Gratitude+Integrity+Vision+Tenacity | Process>Outcome | Sizing>Position

This. Is. The. Way.

****

KVP is Co-Founder & Chief Consigliere @ House D·Central – A World Class, Bespoke & High-End Advisory Home To Crazy RockStar Creatives, Unconventional Talent, that’s founded on the D·Centralized Hive.

The words of House D·Central are:

The words of KVP are his own & should not be construed as investment nor financial advice, nor an official view of D·Central, its clients, partners nor any other part of D·Central’s EcoSystem.

A Macro + Crypto Padawan (2013), KVP also masquerades as an Angel Investor (currently not allocating – thx), very selective Non-Executive Director, Consigliere & Builder.